SAMPLE MORTGAGE CHECKUP • SAMPLE MORTGAGE CHECKUP

Mortgage Checkup

Property Address

According to my calculations a refi could make sense for you.

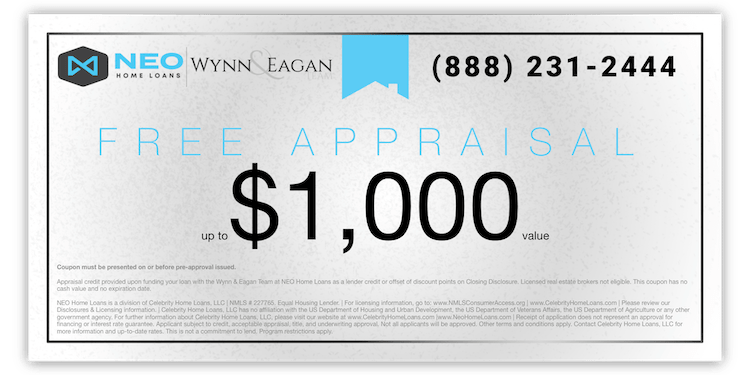

As a valued client you get UNLIMITED free appraisal certificates for you or anyone you know!

No spam. No follow up. Just the certificate for you to use whenever you're ready.

Estimated Loan Balance

$000,000

Your estimated loan balance is based on making minimum monthly payments since closing.

Close

Date

Jan 2020

Loan

Program

Conventional

Loan

Term

00 years

Original

Balance

$000,000

Interest

Rate

0.000%

Estimated Home Value (Zillow/Redfin)

$000,000

Equity: 0.0%

The best method for an accurate home value estimate is a Comparative Market Analysis. Would you like a complimentary customized CMA?

Homebot is a complimentary tool provided to all our clients to help them manage their home equity & grow their wealth. Every month we send you a real estate wealth digest with an estimated home value.

Can you help me out? Can you tell me how helpful this information is for you?

Payoff accelertaor snapshot

Save up to $00,000

Small additional principal payments can add up. Here are a few options if you'd like to accelerate your mortgage payoff:

Round Up

Simply round up your monthly payment to next next $100

(min $10 additional)

+$000/mo

Estimated Savings:*

$00,000

Bi-Weekly

Divide your payment in half and pay it every other week

(or pay the equivalent amount monthly)

+$000/mo

Estimated Savings:*

$00,000

Lump Sum

Pay down your balance with annual tax refunds or bonuses

(savings based on $2,400/yr)

+$200/mo

Estimated Savings:*

$00,000

*Estimated calculations and should not be relied upon to make an informed decision. To discuss specific details about prepayment please contact us.

Homebot is a complimentary tool provided to all our clients to help them manage their home equity & grow their wealth. You can run payoff accelerator scenarios within your account.

Refinance analysis

According to my calculations a refi could make sense for you

You may be eligible to remove mortgage insurance without refinancing.

Simply put, refinancing doesn’t always make sense…or cents. Too often consumers are lured into refinancing to a lower rate and payment to later realize the refinance ended up costing them more than if they hadn’t.

Here are a few reasons you may consider a refinance:

Reduce Interest Rate

If your interest rate is higher than the current market rate you may want to consider refinancing to lower your rate and monthly payment.

Eliminate Mortgage Insurance

Mortgage insurance protects the lender...not you! The sooner you can remove mortgage insurance the more you could save but you must consider the rate, loan term and your financial goals.

Loan Term

Depending on your short-term & long-term financial goals speeding up or slowing down the pace at which you are paying off your mortgage could help you to achieve financial freedom sooner!

Debt Consolidation

Do you have higher interest rate debts like credit cards, auto loans, or student loans? Pulling cash out to pay off these debts and extending the time you pay them off could drastically increase your monthly cashflow position!

Home Improvements

Have some home upgrades you would like to make but don't have the cash to do it? A cash-out refinance could give you access to the money you need to make it possible.

Home Purchase

Dreaming of being a real estate mogul? Or maybe just looking to buy a vacation home? Then consider pulling out cash from your primary residence to secure better terms on your next home purchase.