20 Percent…the magic number for mortgages, right? Well, I am here to tell you that 20% down payment is not always best. Sometimes putting down less money can be better for YOU.

20% Down Payment

20 percent down is the point where mortgage insurance is not required when using a conventional mortgage. So, if you had the choice between putting 17% down (or something close to but less than 20%) and a full 20% down you would normally want to put 20% down so you can avoid the mortgage insurance.

The savings you realize by not having to pay mortgage insurance can be substantial. Avoid it, if possible, right?

Not only is it costly, but it costs you money for something that really doesn’t benefit you.

Risky Business

Mortgages are risky business. Just imagine for a moment that you had some sizable amount of money you could lend to someone else to make a home purchase…say $300,000.

What do you want to know about the person you are going to lend that money to? Probably a lot of the same stuff mortgage lenders require of you – tax returns, pay check stubs, bank statement, etc.

Mortgage companies do this because they are taking a risk by lending you a nice chuck and change. They want to make sure they get their money back.

This is the same rationale for why mortgage insurance exists. It is based on risk. The less money a buyer puts down on a mortgage the higher risk they are to default. And that is not something mortgage companies just think they have statistical evidence to prove it.

How Mortgage Insurance Works

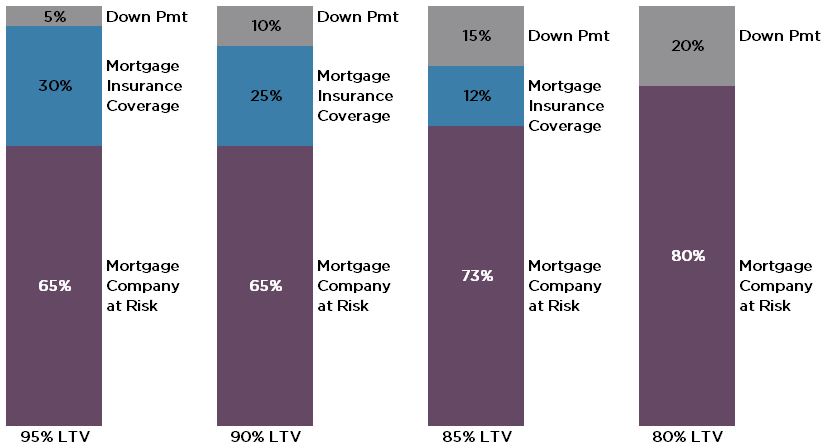

Understanding that mortgage insurance is used to mitigate the risk to the lender let me show you how mortgage insurance works to reduce the risk to the lender.

Mortgage insurance does not protect the lender for the entire balance of the loan, but rather just a certain portion floating at the top.

Depending upon the down payment amount the amount of mortgage insurance coverage changes. The less money down the higher the required coverages. For example, a 5% down conventional mortgage normally requires a 30% mortgage insurance policy while a 10% down conventional loan only requires 25%.

Obviously, with less coverage comes a lower cost to you. The more money you put down the less mortgage insurance will cost you until you get to a full 20% down at which point mortgage insurance is no longer required.

Interest Rates are Based on Risk

Just like mortgage insurance, interest rates are also based on risk. The higher the risk the higher the rate.

As I mentioned earlier, putting less money down is a higher risk to the mortgage company and therefore interest rates tend to be higher when putting less money down.

So if both mortgage insurance and interest rates are negatively impacted by a lower down payment…

Why Would I Not Put 20% Down?

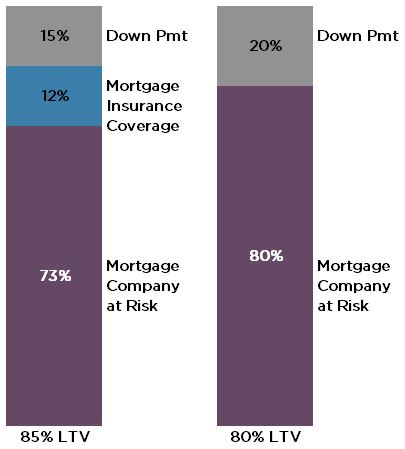

It goes back to the risk to the lender. Take a look at the difference between a 20% down payment and a 15% down payment from the lender’s perspective:

As you can see the lender has more protection with an 15% down payment than it does with the 20% down payment due to the mortgage insurance policy. At a 15% down payment the lender is only responsible for 73% of the price in the case of a default after the mortgage insurance policy protects the first 12%. With a 20% down payment the lender would be responsible for the full 80% of the price, since there is no mortgage insurance float to protect the lender.

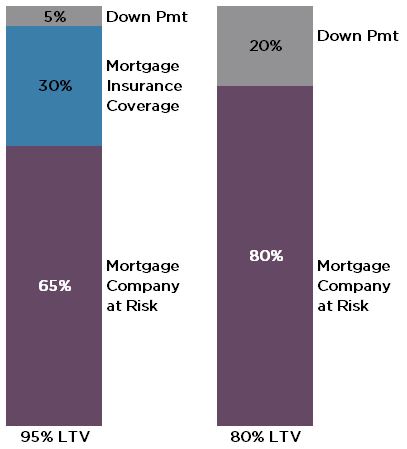

The same can be said for a 5% down payment and a 20% down payment:

In this case the lender would be responsible for 65% of the price with a buyer putting down just 5% while 20% down makes the lender responsible up to the 80% mark.

Tipping the Scales

There is a point where the scales may tip in favor of not putting 20% down to avoid mortgage insurance. Lots of factors play into this including, but not limited to:

- Property Type

- Loan Amount

- Loan Term

- Fixed versus Adjustable Rate

- Credit Score

- Debt-to-Income

What could happen is the creation of a “sweet spot” where the benefit from the lower risk to the lender due to the mortgage insurance coverage outweighs the higher risk that impacts the interest rate.

I will say this does not happen often, but it can happen and is worth looking into when you are considering a 20% down payment. It would be frustrating to find out you scraped together a full 20% down payment when you didn’t need to, right?

Instead the lender can cover the cost of your mortgage insurance through the rate allowing you to still have no monthly mortgage insurance, even with just 15% down payment.

Consultative Approach

The Wynn Team at Citywide Home Loans is not just any mortgage lender. We are licensed mortgage professionals looking out for the best interest of our customers.

We assess situations like the one explained in this post. We review every person’s unique circumstances when designing the right mortgage loan package.

There is no one-size-fits-all when it comes to selecting the right mortgage for you. There are many factors that play into determining the available loan programs based on your qualifications. There are many factors that should be considered when structuring the right loan package that suits your individual needs and not the needs of the majority. You are unique and we treat you that way…as you deserve!