Mortgages are simply a calculation of risk.

No different from insurance. When applying for independent health or life insurance you answer a series of questions and undergo some health screening. This is done by the insurance company to determine you as a “risk”. Because that is what you are…a risk. The insurance company makes money by collecting premiums and avoiding paying benefits. By determining how likely they are to have to pay out based on your “risk” they can properly calculate the premium you will be required to pay.

Mortgages work the same way but we look at very different things…no health screening done by your mortgage company.

What Matters Most?

When the mortgage company looks at their risk they are trying to determine how likely, or unlikely, you are to default on the mortgage. Whether that is something as simple as a late payment or as serious as a foreclosure.

To do this they are looking at your ability to make your monthly mortgage payment for the entire time period of your mortgage (normally 30 years). The mortgage company does not necessarily care how much of a home you are purchasing or how much of a loan you are getting but rather how much of a payment you will need to pay month, after month, after month.

Gross Income

Before we can start talking about ratios we need to understand where the ratio calculation starts, and that is with your income.

Gross income is the income you earn prior to any taxes or deductions (unless you are self-employed, but that is a whole different story) and is used for all mortgage calculations.

Income Sources

Your gross income can come from a variety of sources, including but not limited to:

Salary

Salary- Hourly

- Bonus

- Overtime

- Commission

- Tips

- Self-Employment

- Rental Property

- Social Security

- Disability

- Alimony

- Child Support

- Dividends

- Interest

- Retirement

Depending upon the source of income there are different rules as to when we can use it and how it is calculated. The rules surrounding income calculations are quite long so I will summarize this as best I can.

- Salary income is simply divided by 12 months to calculate the monthly earnings.

- Hourly income is calculated by your hourly wage multiplied by your average hours per week (up to 40hrs/week max) and then calculated as a monthly amount.

- Variable income (bonus, overtime, commission, tips, etc.) must have a two year history to be used and is calculated as an average over a two year period of time.

- Income with an end date (alimony, child support, etc.) must have at least a three year continuance after closing to be used as income.

Do you have an income source that was not covered? If so we would be happy to assist you one on one.

Two Ratios

Once income is determined we can then calculate the ratios. When determining how much you can afford two numbers are reviewed – housing ratio and debt ratio.

Housing Ratio

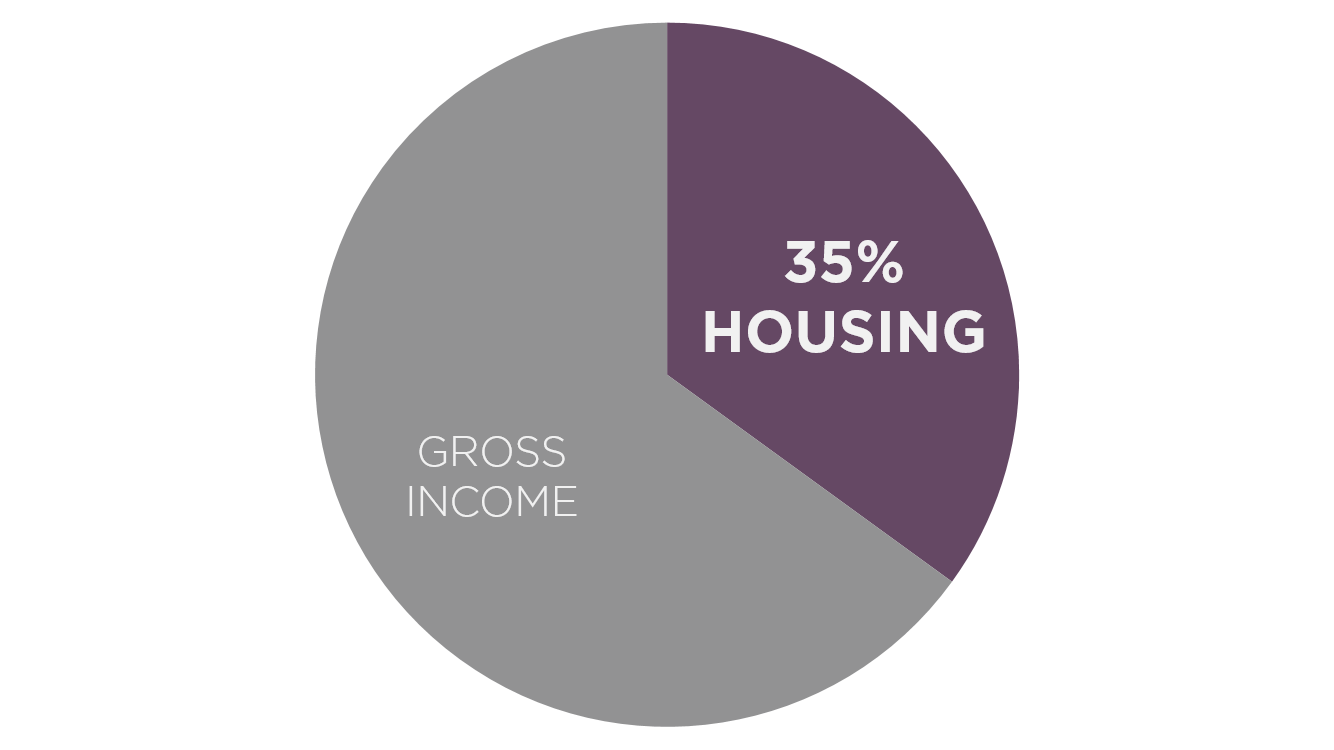

The first ratio is the housing ratio and is a calculation of how much of a house payment you can afford based on the income you earn.

Although the housing ratio limits may vary from one loan program to another, a good rule of thumb for the housing ratio is 35% of your gross income. This means that whatever your total income is calculated to be, you would simply take 35% of that number to determine your housing ratio.

Although the housing ratio limits may vary from one loan program to another, a good rule of thumb for the housing ratio is 35% of your gross income. This means that whatever your total income is calculated to be, you would simply take 35% of that number to determine your housing ratio.

For simple math I’ll use $10,000 in gross income. That means that $3,500 is your housing ratio.

So, what does that mean? Well, that means that the mortgage company says (based on historical risk calculations) that you can afford up to 35% (or $3,500 in our example) on a housing payment.

What’s Including in the Housing Payment?

When we refer to a housing payment we are referring to PITI + MI + HOA:

- P = Principal

- I = Interest

- T = Property Taxes

- I = Homeowners Insurance

- MI = Mortgage Insurance

- HOA = Homeowners Association

Debt Ratio

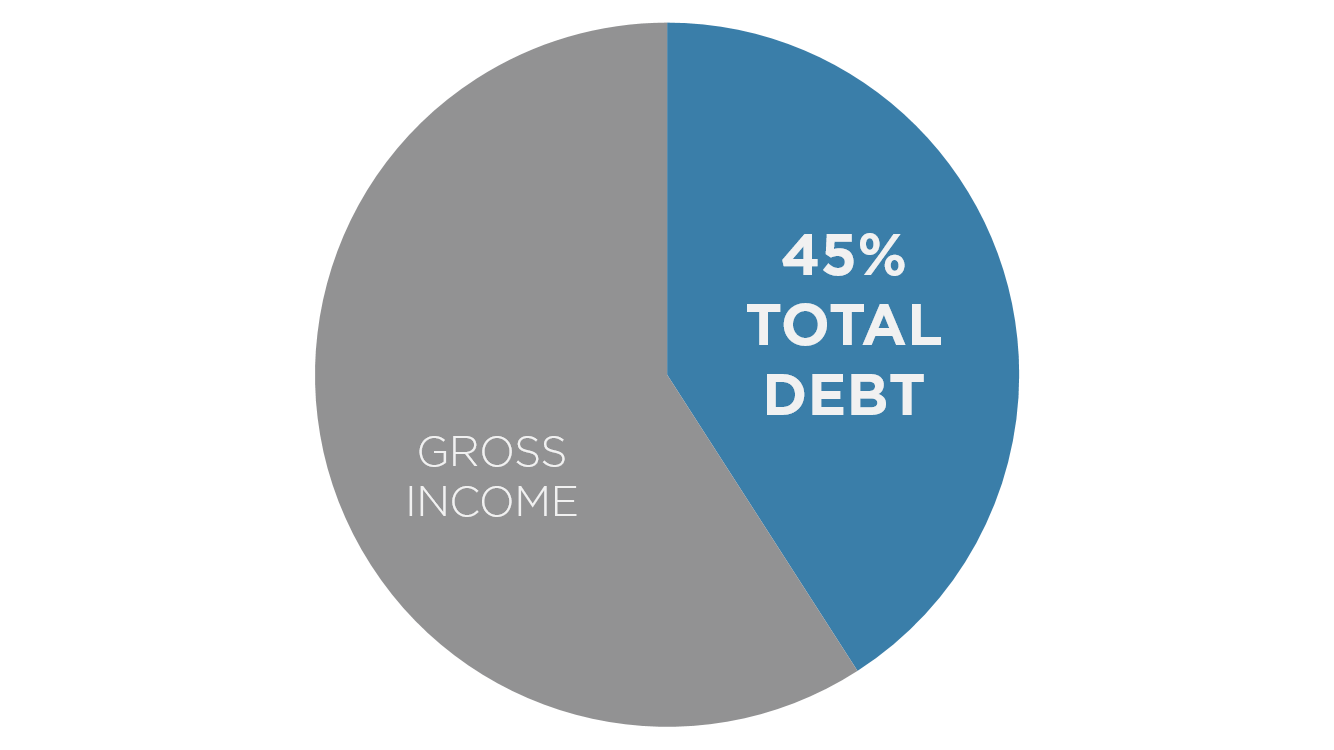

The second ratio is called the debt ratio or DTI for “debt-to-income ratio”. This ratio is calculating how much you can afford in total debt, including the housing payment.

Again, each loan program may have some differences to the guideline or maximum, but the general rule is a DTI of 45%.

Again, each loan program may have some differences to the guideline or maximum, but the general rule is a DTI of 45%.

Going back to our income example of $10,000 that means we can have total monthly debt payments of about $4,500.

From this debt ratio calculation we then subtract out the minimum monthly payments you are required to pay (per credit report or court order such as alimony or child support). That leaves us with the amount remaining that can be used for the housing payment.

Which Ratio is Used?

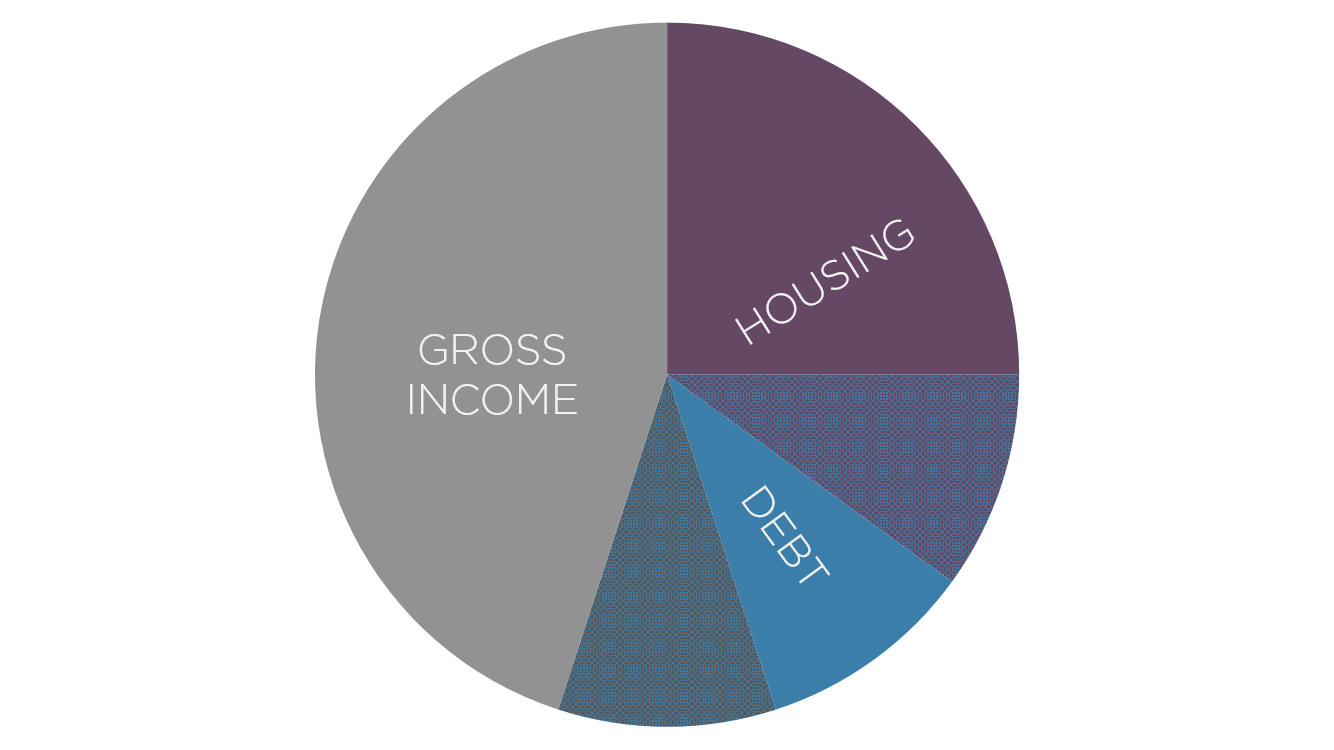

Mortgage companies look at both ratios to determine the risk, however the debt ratio generally holds a bit more weight than the housing ratio.

As you look at these two ratios you can see that the mortgage company would like to see your debt payments at or below 10% of your gross income. But what happens if your debts are higher than 10% (or lower)?

It Depends

The standard answer in mortgage is, “it depends”. There are so many rules, guidelines, considerations and factors that there normally is not just one black and white rule. Ratios are no different.

If your debt exceeds 10% then the pie chart can move in one of two directions. Either reduce your housing payment or push the debt piece of the pie out.

If your debt exceeds 10% then the pie chart can move in one of two directions. Either reduce your housing payment or push the debt piece of the pie out.

Returning to the reason ratios are calculated in the first place, risk is the driving factor. The mortgage company does not want to increase your debt, reducing the income left over for other expenses you have in life such as gas, groceries and entertainment. Because that increases the risk to the lender, there are only certain reasons the debt ratio can push into the gross income piece rather than the housing piece…all related to risk such as:

- Large down payment

- High credit score

- Loan program (FHA allows for a higher debt ratio than other loan options)

If your debt is lower than 10%, that is a very good thing! In that case the housing ratio, normally, expands to fill the debt piece of the pie that is unused increasing the amount you may qualify for in terms of monthly payment.

Just One Part

Ratios are just one part of the overall mortgage qualification and approval process. There are other factors including credit and assets.

In addition, each person’s situation is a bit different. This information was provided to give you a general overview of how ratios work in general but if you are curious about your unique situation, we are here to help.

Pingback: Which is the Best Mortgage Option for You: Conventional, FHA, VA, USDA